The British-Swedish drugmaker AstraZeneca, which has partnered with Oxford University for developing Covid-19 vaccine, expects results from the late-stage trials on its experimental COVID-19 vaccine later this year. However, it also depends on the rate of infection among trial participants.

Presently, there are about 200 vaccine candidates under development. The vaccine being developed by Oxford and licensed to British drugmaker AstraZeneca is seen as a front-runner.

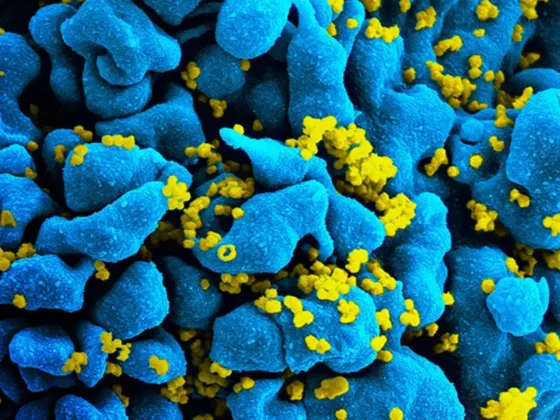

Work on the Oxford viral vector vaccine, called AZD1222 or ChAdOx1 nCoV-19, was started in January, and is formed from a weakened version of a standard cold virus that causes infections in chimpanzees.

ALSO READ| Volunteer In Oxford Covid-19 Vaccine Trial Dies In Brazil, Trial To Continue: Officials

The chimpanzee cold virus has been genetically changed to incorporate the genetic sequence of the so-called spike protein which the coronavirus uses to determine entry to human cells. The hope is that the human body can then attack the novel coronavirus if it sees it again.

AstraZeneca said it’s committed in providing broad and equitable access to the potential vaccine on a not-for-profit basis during the pandemic. Earlier this month, AstraZeneca Plc stated that Britain’s health regulator had started an accelerated review of its potential coronavirus vaccine.

The regulators in rolling reviews are seeing clinical data in real time and have dialogue with drug makers on manufacturing processes and trials to accelerate the approval process.

The approach is designed to speed up evaluations of promising drugs or vaccines during a public health emergency.

ALSO READ| Will Government Have Rs 80,000 Crore For Covid-19 Vaccines, Asks Adar Poonawalla

AstraZeneca beats the third-quarter sales estimates as demand for its diverse portfolio of drugs remained strong during COVID-19 pandemic lockdowns, and it maintained its 2020 forecasts.

Product sales, which exclude payments from collaborations, rose to 7% to $6.52 billion for the three months ended Sept. 30 on a constant-currency basis, ahead of a company-compiled consensus of $6.50 billion.

However, the company reported core earnings of 94 cents per share, lower than analysts’ expectations of 98 cents.